“Helena is an excellent realtor. She is thorough and hard working. She is extremely knowledgeable about Sarasota real estate and was always quick to respond to any questions we had. We will recommend her to anyone who is looking for real estate in Sarasota. ” – SWEDE P L, buyer March 2024

“Helena is an excellent realtor!”

2207 Orange Blossom Ln – Off the market

| This very well-maintained villa is in the maintenance-free 55+ community of Parkway Villas in Bradenton, FL. The lovely condo of 1,037 sq ft (public records) offers two bedrooms, two bathrooms + a bonus/family room with a patio & barbeque area just outside. Ceramic tile flooring in most area and carpet in living room. Separate storage/laundry room in carport just outside the kitchen door with washer & dryer + room for your all your tools. Parkway Villas offers many amenities including gas & solar heated pool, shuffleboard courts, pool table, clubhouse, and an active social calendar. The low maintenance fees ($431 monthly) include cable TV & internet, exterior & ground maintenance, heated pool, clubhouse and shuffleboard. Parkway Villas is a pet free community and no rentals allowed until after 2 years of ownership. Your new home in the sun awaits! |

Listing #: A4601192 Price: $229,000 Address: 2207 Orange Blossom Ln, Bradenton State: Florida Zip: 34207 Bedrooms: 2 Bathrooms: 2 Square Ft. : 1037 County: Manatee Subdivision: Parkway Villas |

661 Poinsettia Ave unit 210 – For sale

|

Opportunity and rarely available with price NOW improved! This second-floor unit in Penthouse Shores, a small complex on North Clearwater Beach, comes fully furnished. This one-bedroom condo comes with one full bath plus a half bath that could easily fit a shower and become a full second bathroom. The unit is available for its new owner for the season to use for himself, or to rent. One month minimum rental is allowed, and amenities include heated pool, barbeque area, laundry, and parking/guest parking. The laundry facility is conveniently located on the elevator landing right outside this unit. The outstanding location with high walkability factor provides easy access to all the fun activities Clearwater Beach has to offer both day and night, restaurants, shopping, marina, boat ramp, gym, yoga, Pinellas Trail, and more. Plus, you’re only two blocks away from one of the best beaches in the US with its magnificent sunsets over the Gulf of Mexico. Your new home in the sun awaits! |

Listing #: A4592322 Price: $399,000 Address: 661 Poinsettia Ave #210, Clearwater Beach State: Florida Zip: 33767 Bedrooms: 1 Bathrooms: 2 Square Ft.: 924 County: Pinellas Subdivision: Penthouse Shores

|

232 Hidden Bay Drive #504 – For sale

|

Listing #: A4593207 Price: $699,000 Address: 232 Hidden Bay Drive, Osprey State: Florida Zip: 34229 Bedrooms: 3 Bathrooms: 3 Square Ft.: 2,000 County: Sarasota Subdivision: Hidden Bay

|

||||||||||

555 S Gulfstream Ave unit 602 – For sale

| Breathtaking views of Sarasota Bayfront await from this sixth-floor unit in Royal St. Andrew in downtown Sarasota. With just under 1,500 square feet this nicely updated two-bedroom, two-bath condominium gives you the perfect place to relax and enjoy the Florida lifestyle. The well-maintained unit comes fully furnished and features an open floor plan, with double sliding glass doors off the living room opening to glassed-in balcony with unobstructed sunset views of Sarasota Bay, Siesta Key, Lido Key, Bird Key and downtown Sarasota. Enjoy tranquil sunset views while preparing dinner in the kitchen with an abundance of cabinetry and granite countertops. Hurricane windows in LR + Master BR, hurricane shutters for inner sliding doors, and solar reflective 3M hurricane film on outer sliding doors. Wood flooring in living/dining room and kitchen. Ceramic tile flooring in hallway and baths. The spacious bedrooms feature new carpets, ceiling fans and sliding doors to the enclosed balcony. An extra bonus is the spacious in-unit laundry room with cabinetry and your private storage space in the hallway right outside the unit. AC from 2018, waterheater from 2023. Rentals are allowed for a minimum of one (1) year.

Royal St. Andrew is a well-established, contemporary-style condominium community where residents enjoy a heated pool, secure lobby entrance, social room with kitchen, fitness center, on-site manager, and more. No pets allowed. With a superb location you are just minutes from everything downtown Sarasota has to offer; dining, shopping, Marina Jack, Burns Court, opera house, museums and more. Easy access to Lido Key beaches, St. Armands Circle and the award-winning beaches on Siesta Key. Sarasota Bradenton International Airport is only 15 minutes away. |

Listing #: A4588253 Price: $959,000 Address: 555 S Gulfstream Ave #602, Sarasota State: Florida Zip: 34236 Bedrooms: 2 Bathrooms: 2 Square Ft.: 1,482 County: Sarasota Subdivision: Royal Saint Andrew

|

417 Avenida de Mayo – Off the market

|

Location, location! Siesta Key Canal front, pool home featuring 3 bedrooms and 3 full bathrooms. Excellent income history. Tucked away on the nice and calm Avenida de Mayo, yet only a few hundred yards away from the buzz, the bars, restaurants etc in Siesta Key village. And less than ½ mile from the beach. Bring your boat – this property has a dock. Great opportunity for an investor who is looking for steady rental income or make this your own personal retreat in the sun on a canal on Siesta Key. |

Listing #: A4556758 Price: $1,750,000 Address: 417 Avenida de Mayo, Sarasota State: Florida Zip: 34242Built: 1960 Bedrooms: 3 Bathrooms: 3 Square Ft.: 1,385 County: Sarasota Subdivision: Siesta Key |

|

|

|

“Helena was highly engaged & dedicated!”

“Helena Nordstrom was highly engaged and dedicated to perform well while selling my home. She went that extra step to meet the Customers’ special needs to provide an optimal buying opportunitity.”

Lawrence Paul Rosenbaum – Seller, December 2022

“Helena Nordstrom is extremely professional and knowledgeable.”

“Helena Nordstrom is extremely professional and knowledgeable. She guided us through the entire process of selling our home with competency and efficiency. Helena listens carefully to her clients and offers sound advice. She was always prompt and clear in her communications and available to attend to any needs or situations. I highly recommend Helena Nordstrom. “

Judy Bokorney, seller

“Per Nordstrom was a delight to work with.”

Per Nordstrom was a delight to work with. He made buying a home uncomplicated and easy. Every time the lender or settlement firm sent me an email, he would phone me to make sure I saw it and that I understood what it said. I would strongly recommend to anyone buying a home that they consider using Per. – Susan Zellers, buyer, May 2022

“I will hire them for all my future real estate needs…”

I am very happy with the results of work of the Nordstrom team! I know them for few years and they helped me with the design and construction of my new house and with selling my old house. I will hire them for all my future real estate needs and recommend them to my friends! – Mikhail Alperovitch, seller May 2022

“They work hard for their clients…”

She is very friendly professional and knowledgeable. I used Helena’s knowledge and expertise in helping me with design of my new home couple years ago and negotiation with the builder. Team Nordstrom helped me a lot in staging, presenting and selling my old house. They work hard for their clients and know exactly what client needs to present the house in a better way. I am very pleased with their work and will recommend them to my friends! – Tatiana Alperovitch, seller May 2022

“We can highly recommend Team Nordstrom!”

“We are very happy about the way that Helena and Per Nordstrom handled the sales of our condominium. Professional and efficient throughout the process. We can highly recommend Team Nordstrom! ” – Dan Bagger-Sjoback, seller. May 2022

“Helena has been a fantastic agent throughout…”

Helena has been a fantastic agent throughout our process: professional, service minded, experienced, easy to reach and helpful in every way. Thanks to Helena, the process of selling a condo in Tampa from long-distance has been a very manageable process. For us, living in Sweden, it was an obvious advantage that Helena is from Sweden, familiar with the business culture and real estate process of both countries. Finally, being able to use Helena’s and Sotherby’s business network, including a closing agent and a tax consultant, was of great value. I would recommend Helena’s services to any one, needing a trustworthy and professional real estate agent in the Tampa area. A million stars. Thank you. Martin Hansson – seller, May 2022

“We are extremely satisfied with Helena…”

We are extremely satisfied with Helena, everything is done professionally! ” – Soren & Marianne Ohlund, sellers January 2022

Happy New Year / Gott Nytt År 2022

Warmest thoughts and best wishes for a Healthy and Happy New Year 2022. May peace, love, and prosperity follow you always.

“Very professional & incredibly helpful”

Helena was our agent when we sold our home in Venice, Florida. She was very professional and incredibly helpful throughout the sales process. We could not have managed the transaction without her! We can highly recommend Helena and Team Nordström! – Ida & Aina Strand, sellers December 2021

“Excellent service and treatment…”

We want to thank Helena for the excellent service and treatment we received throughout the sales process. It was a pleasure having her as our real estate agent. – Mikael Berglund, seller

“She was very professional and had a great service through the whole process.”

“Helena Nordstrom was very professional and had a great service through the whole process.” – Kent Lundstrom, seller

“We honestly could not have been more pleased with this whole experience. “

We met with Helena and Per to discuss selling the condo of a recently deceased relative. They explained the process and their work with Sotheby’s. We explained that we reside in California and after a few weeks in Florida we would return to California. After signing the paperwork Helena started to work to make sure that we would sign what was needed and she assured us we could work together coast to coast. We had many discussions and we trusted she would handle it. She kept us informed of everything that was happening as it happened. She didn’t hesitate to include our adult son in conversations as he was helping guide his Dad. We honestly could not have been more pleased with this whole experience. Helena remained pleasant and calm through it all and we appreciate that. Tim and Jan Lynch – Seller, Siesta Key

What is FIRPTA Withholding?

Withholding of Tax on Dispositions of United States Real Property Interests

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to the Foreign Investment in Real Property Tax Act of 1980 (FIRPTA) income tax withholding. FIRPTA authorized the United States to tax foreign persons on dispositions of U.S. real property interests.

A disposition means “disposition” for any purpose of the Internal Revenue Code. This includes but is not limited to a sale or exchange, liquidation, redemption, gift, transfers, etc. Persons purchasing U.S. real property interests (transferees) from foreign persons, certain purchasers’ agents, and settlement officers are required to withhold 15% (10% for dispositions before February 17, 2016) of the amount realized on the disposition (special rules for foreign corporations).

In most cases, the transferee/buyer is the withholding agent. If you are the transferee/buyer, you must find out if the transferor is a foreign person. If the transferor is a foreign person and you fail to withhold, you may be held liable for the tax. For cases in which a U.S. business entity such as a corporation or partnership disposes of a U.S. real property interest, the business entity itself is the withholding agent.

U.S. Real Property Interest

A U.S. real property interest is an interest, other than as a creditor, in real property (including an interest in a mine, well, or other natural deposit) located in the United States or the U.S. Virgin Islands, as well as certain personal property that is associated with the use of real property (such as farming machinery). It also means any interest, other than as a creditor, in any domestic corporation unless it is established that the corporation was at no time a U.S. real property holding corporation during the shorter of the period during which the interest was held, or the 5-year period ending on the date of disposition (applicable periods).

An interest in a corporation is not a U.S. real property interest if:

- Such corporation did not hold any U.S. real property interests on the date of disposition,

- All the U. S. real property interests held by such corporation at any time during the shorter of the applicable periods were disposed of in transactions in which the full amount of any gain was recognized, and

- For dispositions after December 17, 2015, such corporation and any predecessor of such corporation was not a RIC or a REIT during the shorter of the applicable periods during which the interest was held.

Rates of Withholding

The transferee must deduct and withhold a tax on the total amount realized by the foreign person on the disposition. The rate of withholding generally is 15% (10% for dispositions before February 17, 2016).

The amount realized is the sum of:

- The cash paid, or to be paid (principal only);

- The fair market value of other property transferred, or to be transferred; and

- The amount of any liability assumed by the transferee or to which the property is subject immediately before and after the transfer.

If the property transferred was owned jointly by U.S. and foreign persons, the amount realized is allocated between the transferors based on the capital contribution of each transferor.

A foreign corporation that distributes a U.S. real property interest must withhold a tax equal to 21% of the gain it recognizes on the distribution to its shareholders.

A domestic corporation must withhold tax on the fair market value of the property distributed to a foreign shareholder if:

- The shareholder’s interest in the corporation is a U.S. real property interest, and

- The property distributed is either in redemption of stock or in liquidation of the corporation.

Exceptions from withholding

Generally you do not have to withhold in the following situations; however, notification requirements must be met:

- You (the transferee) acquire the property for use as a residence and the amount realized (sales price) is not more than $300,000. You or a member of your family must have definite plans to reside at the property for at least 50% of the number of days the property is used by any person during each of the first two 12-month periods following the date of transfer. When counting the number of days that the property is used, do not count the days the property will be vacant. For this exception, the transferee must be an individual.

- The property disposed of is an interest in a domestic corporation if any class of stock of the corporation is regularly traded on an established securities market. However, this exception does not apply to certain dispositions of substantial amounts of non-publicly traded interests in publicly traded corporations.

- The disposition is of an interest in a domestic corporation and that corporation furnishes you a certification stating, under penalties of perjury, that the interest is not a U.S. real property interest. In most cases, the corporation can make this certification only if either of the following is true.

- During the previous 5 years (or, if shorter, the period the interest was held by its present owner), the corporation was not a USRPHC.

- As of the date of disposition, the interest in the corporation is not a U.S. real property interest by reason of section 897(c)(1)(B) of the Code. The certification must be dated not more than 30 days before the date of transfer.

- The transferor gives you a certification stating, under penalties of perjury, that the transferor is not a foreign person and containing the transferor’s name, U.S. taxpayer identification number, and home address (or office address, in the case of an entity).

- The transferor can give the certification to a qualified substitute. The qualified substitute gives you a statement, under penalties of perjury, that the certification is in the possession of the qualified substitute. For this purpose, a qualified substitute is (a) the person (including any attorney or title company) responsible for closing the transaction, other than the transferor’s agent, and (b) the transferee’s agent.

- You receive a withholding certificate from the Internal Revenue Service that excuses withholding. See Withholding Certificates , later.

- The transferor gives you written notice that no recognition of any gain or loss on the transfer is required because of a nonrecognition provision in the Internal Revenue Code or a provision in a U.S. tax treaty. You must file a copy of the notice by the 20th day after the date of transfer with the Ogden Service Center, P.O. Box 409101, Ogden, UT 84409.

- The amount the transferor realizes on the transfer of a U.S. real property interest is zero.

- The property is acquired by the United States, a U.S. state or possession, a political subdivision, or the District of Columbia.

- The grantor realizes an amount on the grant or lapse of an option to acquire a U.S. real property interest. However, you must withhold on the sale, exchange, or exercise of that option.

- The disposition is of an interest in a publicly traded partnership or trust. However, this exception does not apply to certain dispositions of substantial amounts of non-publicly traded interests in publicly traded partnerships or trusts.

For more information go to:

https://www.irs.gov/individuals/international-taxpayers/firpta-withholding

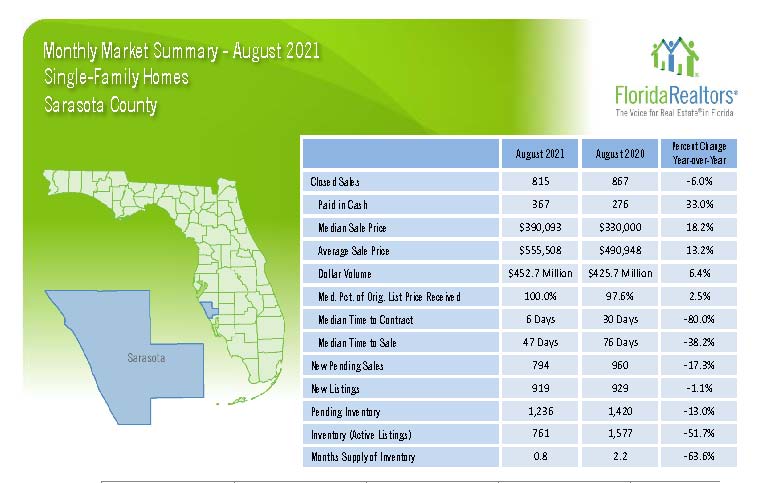

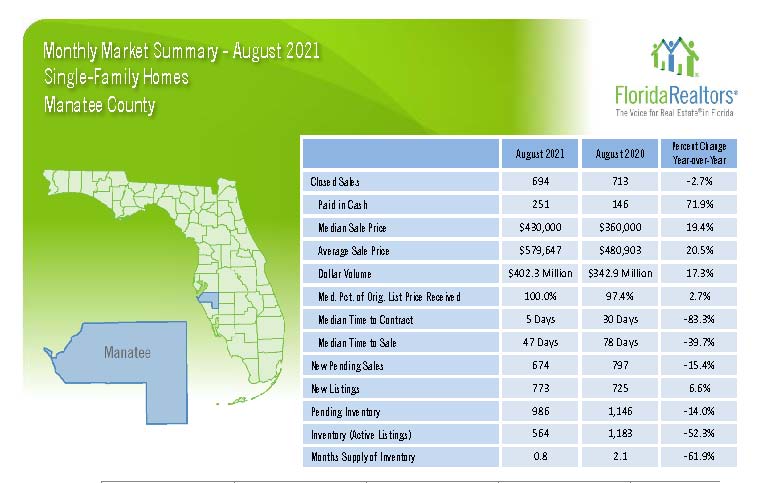

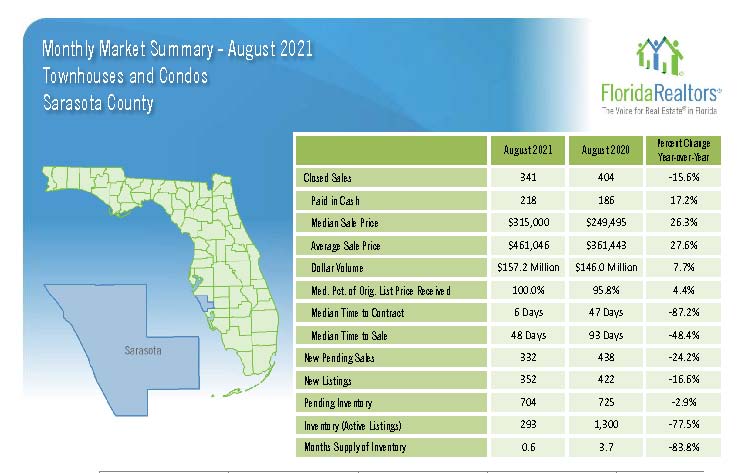

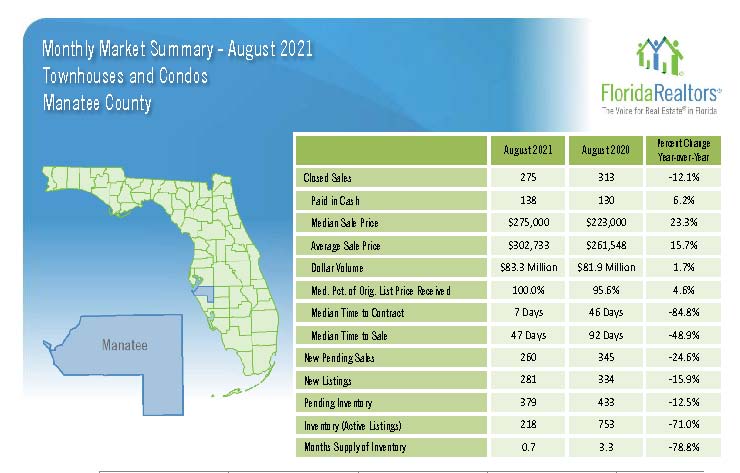

Market Stats for Sarasota & Manatee counties August 2021

Housing prices continue to rise in Sarasota and Manatee Counties, marking the 15th consecutive month of year-over-year price increases for single-family homes. “We’re just a few months out from our high season, and right now we have about half the number of available homes than we did this time last year. There is still enormous buyer demand—expect competition, and therefore prices, to continue to rise,” said 2021 RASM (Realtor Association of Sarasota & Manatee) President Alex Krumm.

“Recently I had the pleasure to work with Team Nordstrom…”

Recently I had the pleasure to work with Team Nordstrom to sell my primary residence in Osprey, Florida.

Team Nordstrom brought calm and precise professionalism combined with a depth of knowledge and a willingness to go as far as was needed to work with all the other parties involved in the sale. They helped to stage, and present the property to interested parties, offered concise opinions on how to approach selecting offers and were on hand for all the review processes, recording and closing of the sale. I was so pleased to have their high energy and positivity to help me sail swiftly through the process.

My principal point of contact was Helena Nordstrom. She was responsive and always available to answer any of my questions and to allay any fears or nerves I had about the process all the way through to the end. Helena was available for all showings and constantly offered assistance in all ways from packing to personally meeting some requests of the owners to be.

It is also a family affair with Per Nordstrom also participating in making sure the entire process ran smoothly as well as helping to stage and photograph the home to its best effect.

I cannot truly express how thankful I am for the smooth and efficient guidance Helena and Per contributed to the entire process.

Very simply. If you are seeking to hire a realtor who will best serve your interests and your desire to sell your home and achieve the best outcomes, simply hire Helena & Per of Team Nordstrom and Sotheby’s International Realty. – Christine Watler, seller June 2021

“Sold our home at highest price ever seen in our area!”

Team Nordstrom´s efforts in connection with the sale of our villa were outstanding. Within less than one month managed to market and sell our home, just in time before we left for Europe and to the highest price ever seen in our area! Their efforts were characterized by professionalism in terms of knowledge, efficiency and not least the care of the customer and customer satisfaction. Besides their well-established network, all the questions we encountered were solved. Especially Helena has a well-developed sense of how to present a home to appeal to a buyer. So, the next time we are going to buy or sell a home, our choice of realtor is obvious – namely Team Nordstrom. We highly recommend Team Nordstrom. – Lars & Agneta Johansson, sellers. May 2020.

“I was very comfortable with their approach and honesty.”

Recently, I closed on my property in Sarasota, Florida. I used your Reality Agency to represent me, as the seller. I was fortunate to have the Nordstrom Team as my Sales Associates. Per and Helena Nordstrom were extremely familiar and knowable about the Sarasota market. When I interviewed them, I was very comfortable with their approach and honesty. I was out of town for most of the viewings and had asked Helena and Per to only show the property when they were available to be there. They were very accommodating and kept informed of all the showing and buyer feedback. Their staging of my property was professionally done. and I felt, increased the chances of a successful sale.

At the time there was a flood of homes, in my category, on the market. I was concerned I would have to lower my price. That did not happen. Helena, who was the lead Sales associate, assured me that we were in a good position based on her extensive study of the market. Soon I had two offers one at asking price and one slightly above asking. I was very satisfied with the results.

The closing was complicated the property being in a trust. My three sons were the Trustees, and all lived out of state. Helena had to work extra hard to get the closing done on schedule.

I have been involved in real estate for many years and have bought and sold several properties in the past. This real estate experience was one of the better experiences, thanks to the Nordstrom team. Thank you, Helena and Per! – Jim Ciulla, seller

8960 Huntington Pointe Drive – Off the market

|

Car/motorcycle lovers dream home! |

Listing: A4460565 Price: $389,000 Address: 8960 Huntington Pointe Drive City: Sarasota State: Florida Zip: 34238 Built: 1993 Bedrooms: 3 Bathrooms: 2 Living area sq ft: ,1,813 Total square feet: 2,436 County: Sarasota Subdivision: Huntington Pointe View map of this location  |

|

|

Team Nordstrom OPEN HOUSES this Sunday, December 15th!

We’re holding two exceptional properties open this Sunday, December 15th at 1 – 4 pm.

- 1642 Stickney Point Rd unit 102, Sarasota, FL 34231 – Offered at $399,000

http://www.teamnordstrom.com/1642-stickney-point-rd-for-sale/ - 4486 Deer Creek Blvd, Sarasota, FL 34238 – Offered at $525,000

http://www.teamnordstrom.com/4486-deer-creek-blvd-for-sale/

“Without a doubt these guys are the best we have ever dealt with.”

“Helena and Pier were fantastic. We have bought and sold a lot of property over the years. Without a doubt these guys are the best we have ever dealt with. Our home was under contract in less that 2 weeks. If you want organized, efficient, hands on, detail oriented pros, these people should be your choice..” – Sellers, Quinto Drive. November, 2018

Till salu: Lättskött hus med pool i “gated community”- SÅLT

i en ”gated community”? Detta välskötta hus i Sarasota är kanske just vad ni söker?

Med en härlig öppen planlösning om ca 140 kvm, två sovrum, två badrum samt ”finrum”/bibliotek, är detta hus inflyttningklart och redo för sin nye ägare.

Huset byggdes 2003 med helgjutna väggar och stål-förstärkta väggar för att stå emot väder och vind. Dessutom finns extra orkanskydd i stål för alla fönster. Lättskötta ljusa kakelgolv i de öppna ytorna och nya heltäckningsmattor i sovrummen samt ”finrummet”. Köket har helt nya rostfria köksmaskiner (augusti 2018). Den privata poolen ligger mot söder och är helt insynsfri och har matplats under tak i skuggan.

Begärt pris: 339,000 USD.

Trevliga VillageWalk är en sk. ”gated community” med vakt 24/7, stort klubbhus, poolområde, tennis, fitness, kafe´, frisör, och bensinstation inom området. Här finns också kilometervis med cykelbanor runt de många sjöarna inom området. Shopping och restauranger finns runt hörnet och till de kritvita stränderna på Siesta Key är det ca 15 minuter med bil.

Kontakta oss för mer information om detta eller andra objekt i Sarasota med omnejd!

Varma och soliga hälsningar,

Per & Helena

“They were extremely knowledgeable..” – Sellers, July 2018

We selected Helena & Per Nordstrom to list our Osprey house in the Woodlands in Rivendell neighborhood. Being a remote owner, the personal attention given to us by both Helena and Per exceeded our expectations. They were extremely knowledgeable of the local market and were very responsive and accessible whenever we needed them. They were spot on with their market analysis and recommendations for what to list the house for. We got an offer within 13 days. They did a great job making recommendations for the staging of the house and were also there to help advise the movers during the packing up of our belongings. We would recommend them without hesitation. Todd & Sandy

Glad Midsommar/Happy Midsummer!!

Glad Midsommar önskar Team Nordstrom!/ Wishing you a Happy Midsummer!!

“HELENA & PER NORDSTROM: 5 STARS + 5 STARS = 10 STARS!!”

HELENA & PER NORDSTROM – 5 STARS + 5 STARS = 10 STARS!!

HELENA & PER WERE WITH US FROM DAY ONE TO TRY TO FIND A CONDO IN SARASOTA COUNTY – HAVING SOLD A HOUSE IN NC. – WE HIT THE GROUND RUNNING!! WE FOUND THAT CONDO – THEN THE PROBLEMS STARTED!! A NEW CONDO TO BE FINISHED IN JULY – WAS FINISHED IN JAN. WHAT MAKES HELENA & PER “REALTORS EXTRAORDINAIRE” WAS THEIR CONTINUED SUPPORT ALL THOSE MONTHS WAITING. THEIR SUPPORT AND FRIENDSHIP WAS SO IMPORTANT TO US AND WE ARE GRATEFUL FOR THEIR PROFESSIONAL EXPERIENCE AND GIVING PERSONALITIES. THEY ARE TERRIFIC AGENTS & FRIENDS. – Arwid & Frances Hansen, June 21018

Till salu – Smakfullt hus med pool och sjöutsikt i “gated community”

Detta smakfullt renoverade hus med pool och sjöutsikt i söder, är beläget i VillageWalk i Palmer Ranch i södra Sarasota. Med ca 180 kvm boyta 3 sovrum, 3 badrum samt arbetsrum/TV-rum, finns det plats för både familj och gästande vänner. Huset, som är byggt 2003, har ett helt nyrenoverat kök med granitbänkskivor och rostfria köksmaskiner, inklusive en vinkyl. Lättskötta ljusa kakelgolv överallt utom i master-sovrummet och ett av gästrummen, där det är ljusa heltäckningsmattor. Vardagsrummet, som är öppet mot kök och matplats, har högt i tak (12 fot) och en inbyggd bokhyllevägg med glashyllor och infällda spotlights. Den privata poolen nås genom de många skjutdörrarna som löper längs hela den södra sidan av huset. Öppna upp och låt känslan av “ute/inne” smälta samman. Den sol- och eluppvärmda poolen har en ny poolvärmare med helautomatisk fjärrkontroll för pool och bubbelpool. Pooldäcket erbjuder plats för såväl soldyrkare, lekar och bad, som sittplatser och matplats i skuggan. Huset har just fått en ny luftkonditionering installerad, och tvättstugan har tvättmaskin och torktumlare från 2016.

Trevliga VillageWalk är en sk. ”gated community” med bemannad gate/security och service avsett enbart för de boende i området. Här finns ett stort klubbhus, två poolområden, tennisbanor, fitness, kafe´, frisör, postkontor och bensinstation. Området erbjuder också kilometervis med cykelbanor runt de många sjöarna inom området. Shopping, restauranger och de kritvita stränderna på Siesta Key finns inom enkelt räckhåll. Begärt pris: 499,500 USD.

För mer information om detta objekt, eller andra objekt i Sarasota-området, kontakta oss!

Varma och soliga hälsningar,

Per & Helena

You’re invited… Open House on Sunday April 8th!

668 Clear Creek Drive – Withdrawn

| This custom-built home with 3 bedrooms + den/bonus room, and 3 baths offers an amazing, secluded backyard with complete privacy, oak trees and a small pond. The open split floor plan has sliding doors all around to the inviting and private pool area with a saltwater pool, spa and comfortable outdoor seating areas. The kitchen with cherry wood cabinets and granite counter tops is open to the family room with cathedral ceilings. The bathrooms all have cherry cabinets and granite counter tops. The spacious master bedroom with tray ceiling and bay window, has his & her walk-in closets, one of them doubles as a safe room from storms. Other features include custom tile flooring, designer ceiling fans, crown molding, tray ceilings, and built-ins in all closets. Exterior windows and doors feature double pane glass with hurricane protective shield. There is also a whole-house water filtration system and hot water re-circulation. Woodlands at Rivendell is conveniently located in Osprey, between Venice and Sarasota. Situated adjacent to top-ranked Pine View School, this lovely neighborhood offers beautiful landscaping, winding sidewalks along the many lakes, scenic nature trails, playground, and a community pool. The Legacy Trail offers miles of biking and exercise opportunities and the white sandy beaches on Casey Key are only minutes away. Virtual tour |

Listing #: A4213934 Price: $479,000 Address: 668 Clear Creek Drive City: Osprey State: Florida Zip: 34229 Built: 2002 Bedrooms: 3 + den/bonus room Bathrooms: 3 Living area sq ft: 2,388 Total square feet: 3,493 County: Sarasota Subdivision: Woodlands at Rivendell View map of this location  |

|

|

|

Open House on Sunday, February 11th 1 – 4 pm!

“They really used their professionalism and put in all efforts to make sure we got our condo sold. “

Me and my wife have all reasons for recommending Helena and Per Nordström ”Team Nordstrom” when you need a Real Estate Agent in Sarasota. They really used their professionalism and put in all efforts to make sure we got our condo sold. They are very easy to communicate with, which makes the whole process so much easier. Thank you again! – Nils-Arne Lindqvist, seller

“Per & Helena Nordstrom are the most professional realtors I have ever used.”

Per & Helena Nordstrom are the most professional realtors I have ever used. I was extremely satisfied with their

efforts on my behalf. I highly recommend Per & Helena Nordstrom if you are thinking of buying or selling in

Sarasota, FL. Sara D’Alessandro, seller. May 2017

“I am yet to find a more conscientious, on the ball, caring and knowledge team.”

Per & Helena are my friends as well as my brokers. I am yet to find a more conscientious, on the ball, caring and

knowledge team. I trust their judgement and advice as well as the execution of the contract, knowing that

they will act in my best interest. Moshe Yohann, seller. April 2017

“Helena truly epitomizes what an agent should be!”

Helena was our agent when we purchased a beautiful house this month. She was always mindful of our needs. She helped us find the right place in a special time limit. Helena truly epitomizes what an agent should be! – Bob & Emily Hamel, buyers, April 2017

“We have never met a realtor that was even close to assist as much as Helena did.”

We have for some time fallen in love with Anna Maria Island on Florida’s Gulf coast. This spring we thought “now or never” and decided to buy a condo. Since we didn’t know anything about the market in the U.S. we wanted help from a Swedish speaking realtor. We found Helena Nordstrom at Team Nordstrom, and so lucky we did.

Besides being a very nice person , she personally filmed and sent us video clips of the condo we were interested in. Her engagement to help us through all paperwork exceeded our expectations (as did the paperwork itself). When we finally crossed the Atlantic to meet with her, only a few signatures remained. She then also helped us to open an American bank account.

Over the years we have bought and sold quite a few apartments in Sweden, but we have never met a realtor that was even close to help us as much as Helena did. Today we not only see Helena as our realtor, but also as our friend.

Johan Hult and Inga-Lena Spansk

Mora, Sweden

“No other Agent gave us the 110% that the both of you did.”

Helena & Per:

Gary and I would like to Thank You for your excellent help in selling our home. Your persistance and unwavering determination was a plus for us as no other Agent gave us the 110% that the both of you did. Even when we were disappointed and ready to “call it quits” you convinced us that you would find a buyer. You did find a buyer. You kept us informed almost daily, took care of all the details and walked us through the process. Basically all we had to do was sign on the dotted line. Thank You Both for making this an easy transition. We would highly recommend your services to anyone looking to sell their home or to purchase a home. Best Regards, Gary & Madeline Wilburn

July, 2016

Venice, FL – en pärla på Florida´s västkust!

Venice, FL – en pärla på Florida´s västkust!

Venice är beläget söder om Sarasota och räknas som en av USA´s trevligaste beachnära orter. Här är tempot lugnare än på många andra håll i Florida, men med en pittoresk stadskärna med uteserveringar och restauranger samt egen teater och konserthall, så finns det alltid något att göra efter att man tröttnat på bad, snäcksamlande och letande av fossila hajtänder på stranden.

Vi hjälper gärna Dig och Dina vänner att köpa, eller sälja fastigheter i Venice-Sarasota-Bradenton! Hör av Dig så berättar vi mer!

Varma och soliga hälsningar,

Per & Helena

Why Sarasota? This excellent video shows why more and more people discover this gem on the Florida Gulf coast!

You are looking to visit Florida and possibly buy properties here, but don´t know where in the state you would like to be? You are looking for beautiful beaches, an active lifestyle including golf and boating, but don´t want to miss out on art, opera, theaters, concerts etc.? Sarasota is the place for you!

This excellent new video produced by Premier Sotheby’s International Realty shows why more and more people discover Sarasota, FL and make it their home. – January 26, 2016

145 Shoreland Drive – Previous listing

| Price improved! Situated on the tranquil South Creek Bayou in Osprey, this custom designed residence offers over 4,100 sf of immaculate and finely detailed living space. The brick pavered circular driveway surrounded by new tropical landscaping sets the scene, leading up to the grand foyer entrance with double glass doors. The magnificent living room serves as a defining centerpiece with 22 feet ceilings, fireplace, wet bar, and the second floor wrap-around catwalk. Guests will enjoy gathering in the kitchen, overlooking the family room. This open space offers stainless steel appliances, granite countertops, an island, and breakfast bar. Separate breakfast area with aquarium windows and direct access to the lanai showcase lovely views while providing a light and bright atmosphere. Formal dining room and library add to the inviting entertainment areas. Two master suites, one downstairs and one upstairs open to terrace and private balcony areas. This home has a soft and inviting interior that can easily support any design style. Outdoor features continue to impress with a vegetable garden, a majestic oak tree with birdlife, and a saltwater pool and spa. With more than 130’ of water frontage, this home is a mariner´s delight with dock (new in 2014) and a 13000 lb. boat lift, and only a few minutes boat ride to the Intracoastal Waterways. Nationally acclaimed Pine View School is only minutes away.Virtual tourVideo |

Listing #:A4136664 Price: $1,849,000 Address: 145 Shoreland Drive City: Osprey State: Florida Zip: 34229 Built: 2004 Bedrooms: 4 Bathrooms: 3(2) Living area sq ft: 4,112 (public records) Total square feet: 6,080 County: Sarasota Subdivision: Towns-End Shores View map of this location  |

|

|

|

“Very professional and helpful.”

Helena and Per Nordstrom of Premier Sotheby´s International Realty were my Real Estate agents for the marketing and subsequent sale of my Condo in Meridian at The Oaks Preserve in Osprey, FL. The staging and photography of the apartment for the marketing, flyers and many internet sites, was excellent. Both Per and Helena were very professional and helpful. -Patricia Morris, seller

“Willing to work hard.”

Both Helena and Per are easy to work with. They are willing to work hard to show the property, network with other realtors, and follow up with prospective buyers. We got more personal service and attention in trying to sell the house than we did with some other realtors. Would highly recommend them. – Pam Mooney, seller

“We could not have chosen a better team to work with than Per and Helena Nordstrom.”

| Having just sold our first house in 15 years we were feeling a little overwhelmed by the new internet technology in the real estate market! We could not have chosen a better team to work with than Per and Helena Nordstrom. Their thorough knowledge of the market and quick response to all of our questions put us immediately at ease. As a team they were able to attend almost every showing at our house, even the last minute ones! We are grateful for their guidance and patience in getting us through this process and look forward to working with them again in the future. It was truly a pleasure!! Thanks so much, Lyn and Bill – sellers, September 2015 |

August 2015 inventory in Sarasota & Manatee drops; prices climb

The active inventory of properties for sale in Sarasota and Manatee counties continued to drop in August 2015, while the median sale prices skyrocketed over last year at this time, demonstrating a strong seller’s market in the region.

According to the Realtor® Association of Sarasota and Manatee, the inventory of single family homes and condos fell to a combined 3,303 in Sarasota County and 2,534 in Manatee County. This compares to 3,745 last August in Sarasota County and 2,724 in Manatee County, or declines of 11.8 percent and 7 percent, respectively. When the market reached an equilibrium between buyers and sellers in 2013, there were roughly 5,500 properties for sale in Sarasota County and 5,000 for sale in Manatee County. Those figures have trended lower for over 30 months, and the current level represents about a 40 percent drop from those recent norms.

The lower inventory continues to propel median sale prices in both counties. In Sarasota County, the single family median climbed 21.1 percent, from $195,750 last August to $237,000 this year. In Manatee County, the increase was 18.8 percent, from $223,000 last August to $265,000 this year. Condo prices were also up substantially, from $177,000 to $220,000 in Sarasota County (24.3 percent) and from $122,000 to $155,000 in Manatee County (27 percent). The median sales prices were propelled by 50 sales in the two-county region topping $1 million. However, balancing the high end were 647 sales below the $200,000 level in the two counties, or 36 percent of the overall market.

“The economic law of supply and demand has dramatically influenced our local market, as we are seeing big jumps in median sale prices year over year,” said Association President Stafford Starcher. “The lack of available inventory compared to the equilibrium levels, and particularly to our inventory peaks in 2006 when we were seeing over 15,000 properties on the market in both counties, is remarkable. Yet, despite the low inventories, we are continuing to see historically high sales numbers. Also, the lower days on market figures means fewer properties are languishing on the market. A property in good condition and priced right is generally selling very quickly.”

Median days on market were between 39 and 57 this August, compared to 55 to 70 days last August, a major drop that indicates homes are moving quickly once they are placed on the market. Also, the two-county area saw the month’s supply of inventory remain well below the 6 month level that defines a market in equilibrium between buyers or sellers. The figures now stand at between 3.2 and 3.6 months in both counties for both single family and condos.

In August 2015, there were a combined 1,709 total sales in both counties, down from July’s figure of 1,974 closings, but up over last August, when there were 1,649 closed sales. The first eight months of 2015 remain on a record pace, and depending on how the final four months fare, we could still see the year end with the highest number of sales in the region’s history.

Sales in Sarasota County hit 1,048 in August, down from July’s figure of 1,174. But the figure was up over last August, which saw 975 closings. Sales topped the 1,000 level for the sixth consecutive month – something that has never happened before in Sarasota County. Manatee County saw total sales of 661 in August, also down from the July figure of 768, and almost identical to the August 2014 total of 674.

“As we enter the fall months, recent history has shown sales have been up and down, with the last quarter traditionally experiencing a drop off,” explained Starcher. “But the fact that the Federal Reserve has so far declined to raise interest rates, and with the continuing improvement in the national and state employment picture, this leads me to be very optimistic about the short term future of our market. We will also have the return of our late fall and winter visitors, some of whom may be in the market to relocate to our area.”

New pending sales, which reflect new contracts written in the two-county area, were down about 5 percent from August 2014, with all categories slumping slightly. Pending sales often reflect the future direction of the market, and the numbers typically drop in August as the market takes a breather from the spring and early summer sales surge.

“This remains a strong market, with potential for future growth,” said Starcher. “Our agents obviously hope to see an increase in the available inventory as prospective sellers realize the opportunity and get into this market. If we see a turnaround soon in the inventory levels, combined with the traditional return of our winter visitors who often decide to move here permanently, I think we’ll have a healthy real estate market the foreseeable future.”

Source: Realtor Association of Sarasota & Manatee

Published: September 21, 2015

by Helena Nordstrom – TEAM NORDSTROM; sales associate, Premier Sotheby´s International Realty in Sarasota, FL

Just sold: 8838 Bloomfield Blvd, Sarasota, FL 34238

This beautiful home just sold. It´s located in Silver Oak, a gated community within Palmer Ranch in Sarasota,FL. It has 4 bedrooms, 3.5 baths, and with views over private backyard and preserves. The home was listed by Team Nordstrom for $719,000 and sold on September 9, 2015 for $702,000, 97.6% of asking price.

If you are in need of a real estate professional to assist you buy or sell a home in Sarasota, Osprey, Nokomis or Venice FL, please call TEAM NORDSTROM – Per & Helena Nordstrom REALTORS at 941-228.7356, or email info@teamnordstrom.com. We would be happy to assist you!

“Professional, knowledgeable, and reliable”

The Nordstroms are very professional, knowledgeable and reliable. They did a good job marketing our property. We have been in very in good hands as sellers, since they looked out for our best. We highly recommend them as realtors. – Eric & Anette Anders, sellers, June 2015

“The epitome of professionalism!”

Helena Nordstrom was an outstanding agent in helping us to sell our lot. She was the epitome of professionalism. She helped find interested parties from her international network, was diligent in updating us on the state of the market and the interest of those parties, and worked hard and creatively to find buyers. I recommend her without reservation. – Jim Swift, seller 2015

“Impressed with their work ethic.”

We were very happy being represented by Per and Helena. They’re knowledge of the Real Estate world in Sarasota was spot on and we believed that helped sell our home. We were particularly impressed with their work ethic. They are both very hard workers and we felt confident that their dedication would pay off, which it did. We highly recommend them.

Jim and Mary Ann Schwarzbach, sellers May 2015

TEAM NORDSTROM – Open house on Sunday June 28th, 1-4 pm

Come see us and our beautiful listing!

Silver Oak – 8838 Bloomfield Blvd, Sarasota, FL 34238. List price: $735,000

Attractive curb appeal and exterior w circular driveway, stone entry columns and stone quoins. Coffered ceilings, crown moldings, gas fire place and more. Upstairs bonus room. Screened-in pool and spa area with two covered sitting areas. Large master suite with bay window.

For more information about this or other area listings, please contact us.

Let us assist you and your friends when buying or selling a home!

Hope to see you Sunday!

Per & Helena

GLAD MIDSOMMAR!

TEAM NORDSTROM – Open houses on Sunday June 7th, 1-4 pm

Come see us and our beautiful listings!

1. Sorrento Shores – 509 Rembrandt Drive, Osprey, FL 34229. List price: $875,000

Waterfront property on over half an acre directly on the Intracoastal Waterway with dock & covered boat lift. Home with split floor plan with two master suites, large lanai and screened-in pool area w Tiki Bar. The best value on the Bay?

2. Silver Oak – 8838 Bloomfield Blvd, Sarasota, FL 34238. List price: $735,000

Attractive curb appeal and exterior w circular driveway, stone entry columns and stone quoins. Coffered ceilings, crown moldings, gas fire place and more. Upstairs bonus room. Screened-in pool and spa area with two covered sitting areas. Large master suite with bay window.

For more information about this or other area listings, please contact us.

Let us assist you and your friends when buying or selling a home!

Hope to see you Sunday!

Per & Helena

Memorial Day 2015

April 2015 sales in Sarasota County hit all-time high!

Property sales in April 2015 in Sarasota County totaled 1,224 (791 single family and 433 condos), exceeding the all-time high reached in April 2004 by a single sale, according to Realtor Association of Sarasota and Manatee.

Manatee County recorded 813 sales (539 single family and 274 condos), not a record, but very high compared to recent months. The historic level of sales activity has been driven by several factors, according to local real estate leaders.

Sales levels in both Sarasota and Manatee counties have been bubbling at the top of historically high levels for several months. In March, overall Sarasota County sales were just below the all-time high, while Manatee County sales were also much higher than the traditional volume seen in recent years. In April, the record in Sarasota was finally exceeded, while in Manatee, sales remained at near the highest level in history. At the current pace, both counties will exceed their all-time annual highs in 2015.

“The Sarasota-Manatee region is one of the hottest markets in the nation because we have tremendous weather, an amazing natural environment, great business climate, good schools, exceptional shopping, and unmatched cultural amenities,” explained Association President Stafford Starcher. “The fact that people want to move here and buy property here is no surprise, and we are no longer a secret in the national and international marketplace.”

In Manatee County, single family homes were selling at a median price of $256,500 in April, up 16.6 percent over last year’s April figure of $220,000. The condo market was selling at $145,000 – a big 9.8 percent higher than last April’s figure of $132,000. Median sale prices were also on the upswing in Sarasota County, with single family homes hitting $221,990, or 13.1 percent above last year’s April figure of $196,250. Condo prices were at 191,400 in April, or 4.3 percent above last April’s figure of $183,500.

“The price level is dependent to a large extent on available inventory, and our inventory has been very low in recent months,” explained Starcher. “Single family and condo listings are down by double digit percentage in Sarasota County from last year at this time. Manatee County has seen similar numbers. We haven’t seen inventory levels this low since last fall, and this market reality tends to propel price appreciation.”

Future sales, which can be projected from the pending sales figure, still look bright in both counties. Sarasota County saw 1,127 new pending sales in April, almost identical to the March number and about 11 percent above last April’s figure. The pending inventory reached 1,713 total. In Manatee County, new pending sales were at 770, down from last month, but above 6 percent above last year at this time. Pending inventory stood at 1,151.

The month’s supply of inventory was between 4.2 and 4.5 months for both counties and for both property categories – well below the 6 month level that defines a market in equilibrium between buyers or sellers. At present, sellers remain in command, based upon that market statistic, which is also reflected in the rising median sale prices.

Distressed sales, short sales and foreclosures, dropped again in April 2015, and now represent only 15.6 percent of the Sarasota County sales and 15.7 percent of the Manatee County sales. In April 2014, over 20 percent of closed sales in Sarasota County and 25 percent in Manatee County were distressed properties.

Distressed property listings fell to only 6 percent of total inventory in Sarasota County and only 7 percent in Manatee County – a major drop from recent months when the figure hovered around 20 percent.

“This is truly an historic time for our real estate market, and residents and visitors alike should be exploring their options when it comes to buying and selling homes and condos,” said Starcher. “There is a steady, positive nature to all the numbers I’m seeing, and this indicates a healthy market with tremendous potential going forward.”

By Helena Nordstrom, sales associate, Premier Sotheby´s International Realty. May 21, 2015.

Just sold by Team Nordstrom – townhouse in Osprey, FL

This lovely townhouse in Blackburn Point Marina Village, Osprey just sold by Team Nordstrom. It has three bedrooms, 3 baths, and is conveniently located just off the northern bridge to Casey Key at Blackburn Point. This home sold on April 24, 2015 for $300,000.

If you are in need of a real estate professional to assist you buy or sell a home in Osprey, FL, or the surrounding cities in Sarasota County, please call TEAM NORDSTROM – Per & Helena Nordstrom REALTORS at 941-228.7356, or email info@teamnordstrom.com. We would love to assist you!

Just sold: 409 N Point Rd unit 602, Osprey, FL 34229

This is an exquisite condo in Meridian at the Oaks Preserve, an exclusive gated community within the fashionable The Oaks Golf & Country Club in Osprey, FL. It has 3 bedrooms, 3 baths, and is overlooking Intracoastal Waterways, Casey Key, Siesta Key and the Mexican Gulf. This home was listed by Team Nordstrom and sold on April 8, 2015 for $435,000.

If you are in need of a real estate professional to assist you buy or sell a home in Osprey, FL, or the surrounding cities in Sarasota County, please call TEAM NORDSTROM – Per & Helena Nordstrom REALTORS at 941-228.7356, or email info@teamnordstrom.com. We would love to assist you!

Come and view these extraordinary homes on Sunday, March 8th 1-4pm:

1. Sorrento Shores – 509 Rembrandt Drive, Osprey, FL 34229. List price: $895,000

This waterfront property with dock and covered boat lift sits on over half an acre directly on the Intracoastal Waterway across from Casey Key. The best value on the Bay?? Home from 1972 with great potential. Conveniently located on the mainland in Osprey, between Sarasota and Venice with shopping, restaurants and Pine View School close by.

2. Cape Haze – 80 Buccaneer Bend, Placida, FL 33946. List price: $1,750,000

Magnificent Key West-style home from 2002 located directly on Intracoastal Waterway in Cape Haze West, Placida. Boater´s dream home w 109 feet of see wall with deep water dockage for four boats, two boat lifts (one covered). Home with almost 5,900 sg ft of living space; spacious eat-in kitchen w granite counter tops and stainless steel appliances, separate dry bar with wine cooler, family room with Coquina stone fireplace. Separate formal dining area and living room. Media room/home theater with comfortable recliner seating for eight. West facing veranda & 2nd floor balcony with expansive views over water and sunsets. Elevator, wine cellar, three AC systems, Manablock plumbing and security system.

3. The Trails– 8757 Viking Ln, Lakeland, FL 33809. List price: $385,000

Priced now $30,000 below appraised value! This custom-built home from 1991 sits on almost an acre in the secluded The Trails/Lakeland Country Club. Cathedral ceilings, deep windows and sliding doors provide for maximum light. Wood burning fireplace in family room. The kitchen with slate flooring has white wood cabinets; an island and a large eat-in area open to the adjacent family room and lanai. The tiled lanai/pool area and pool were completely resurfaced in 2011.

Let us assist you and your friends when buying or selling a home!

Per & Helena

Wishing you a Happy New Year 2015!

Welcome to Sarasota – a lot more than beautiful beaches!

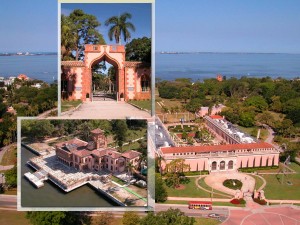

Sarasota is one of Florida’s primary Gulf Coast cities and offers visitors not only pristine sandy beaches, but an eclectic blend of culture and fine dining, circus thrills s, and a wide array of shopping opportunities. The John and Mable Ringling Museum of Art pays homage to the Ringlings, the family behind America’s most famous circus. Check out the old costumes, wagons, and the world’s largest miniature circus at the Circus Museum. Art lovers can appreciate the largest collections of Rubens canvasses in the world, plus works by Old Masters. You can also tour Ca’ d’Zan Mansion, a magnificent 56-room Venetian Gothic palace and the Ringlings’ old family home. Fine shopping is available in many places, including St. Armand’s Circle close to Lido Beach on the coast. Explore the wildlife and Old Florida by boat and kayak along Myakka River and in the Myakka State Park.

Eget hus på golfbana i Florida!

Ett eget hus vid golfbanan är något som många drömmer om!

I sydvästra Florida finns många av USAs bästa golfbanor och varma och solsäkra Florida erbjuder fantastiska förutsättningar för spel året runt.

Vi har nöjet att just nu erbjuda två fina hus som ligger i två mycket trevliga Golf & Country klubbar. Det ena huset ligger längs 4:e fairway på The Tributary Curse i River Strand Golf och Country Club i Bradenton, strax norr om Sarasota. Ett fantastiskt fint område med som vuxit fram under se senaste 5 åren. Nybyggt, mycket välskött och påkostat. Området är ”gated” och har dygnet runt ”security”. Medlemskapet i klubben som ingår när man köper ett hus innehåller förutom 27 håls förstklassig golf, också 8 Har Tru tennis banor, ett imponerande poolområde i ”resort-klass”, ett fitness center och ett 3500 m2 stort klubbhus med full service restaurang, bar och grill room mm.

Det andra huset är en golf-villa i Stoneybrook Golf & Country Club i Sarasota. En väl etablerad och mycket populär ”golf-community”, bara ca 10 minuter från Siesta Key Beach som nyligen utnämndes till USAs bästa strand. Golfbanan, designad av Arthur Hills, är utmanande och trevlig. Området som är ”gated” erbjuder också tennis, ett komplett fitness center, gång och cykelstigar och ett nyrenoverat klubbhus med flera restauranger och barer. Även här ingår medlemskap i klubben när man köper en fastighet i området.

Uthyrning

Många har inte möjlighet att använda sitt hus året runt och vill passa på att hyra ut och på det sättet låta intäkterna täcka kostnader för drift, skatt och försäkring. Både River Strand och Stoneybrook har generösa uthyrningsregler och uthyrning är tillåtet upp till 12 ggr/år. Klubbarna tillåter också att man tillfälligt transfererar medlemskapet till hyresgästen, något som många golfklubbar inte skulle tillåta.

Verkar detta intressant? Slå gärna en signal så kan vi berätta mer. Eller använd vår sökmotor på www.teamnordstrom.com för stt själv söka bland de över 10000 hus och lägenheter som är till salu i denna del av Florida. Kontakta sen oss om du vill ha mer information om något av objekten.

Varma & soliga hälsningar!

Per & Helena Nordström – TEAM NORDSTROM, svensktalande fastighetsmäklare

Sales associates Premier Sotheby´s International Realty, Sarasota, FL

Riverfront Drive, lot 16 – Previous listing

| Experience the – Old Florida – lifestyle! This river front lot of 1.83 acres offers an opportunity to build your dream home on Myakka River in Myakka Country Estates. This small community of only 41 home sites gives you the possibility to experience and live the peaceful and natural – old Florida – lifestyle with the wildlife, the fishing, kayaking, the beauty and the tranquility of the river preserve right in your backyard. Buy this lot alone or together with lot 15 for a 2.83 acres river front estate. Myakka River was designated a – Wild and Scenic River – in 1985 by the Florida Legislature, with the goal to preserve the character of the river. Only two rivers in Florida have this designation. At the same time, only a few miles away you find Venice & Englewood, two charming towns with shopping, restaurants, theaters, art galleries, golfing and the beautiful beaches along the Gulf of Mexico. | Listing #: A4104108 Price: $135,000 Address: Riverfront Drive – vacant lot City: Venice State: Florida Zip: 34293 Bedrooms: n/a Bathrooms: n/a Square Ft.: 79714 County: Sarasota Subdivision: Myakka Country Estates View map of this location  |

|

|

|

Riverfront Drive, lot 15 – Previous listing

P

| Build your dream home on this one acre lot, beautifully situated in Myakka Country Estates, a small community of only 41 home sites. Experience the natural and peaceful – Old Florida- lifestyle with the wildlife, the fishing, kayaking, the beauty and the tranquility of the river preserve right in your backyard. Buy this lot only or together with lot 16 for a 2.83 acres river front estate. Myakka River was designated as a -Wild and Scenic River- in 1985 by the Florida Legislature, with the goal to preserve the character of the river. Only two rivers in Florida have this designation. At the same time, only a few miles away you find Venice & Englewood, two charming towns with shopping, restaurants, theaters, art galleries, golfing and the beautiful beaches along the Gulf of Mexico. | Listing #: A4104102 Price: $125,000 Address: Riverfront Drive – vacant lot City: Venice State: Florida Zip: 34293 Bedrooms: n/a Bathrooms: n/a Square Ft.: 43560 County: Sarasota Subdivision: Myakka Country Estates View map of this location  |

|

|

|

Property sales continue hot streak in Sarasota County – statistics May 2014

The early summer started as hot as the spring in Sarasota County for property sales, with exactly 1,100 closed sales reported in May 2014 – 747 single family homes and 353 condominiums. The figure was slightly lower than April’s total of 1,195, and also slightly lower than last May, when 1,127 closings were reported in the My Florida Regional MLS system. The first five months of 2014 remain ahead of the scorching pace of 2013, an historic year for property sales in the county with the second highest number of sales in SAR’s 91 year history.

“Sarasota County real estate is such an amazing success story in the past two years, particularly coming from where we were in 2010,” said Sarasota Association of Realtors® President Peter Crowley. “I think this is a tribute not only to our home market, which is one of the best in the nation, but also to our collective group of SAR brokers and agents who have truly upped their game. We emerged from a tough environment and are now leading the pack.”

Distressed sales remained far below the levels experienced four years ago, indications of a strong market returning to historic norms. In May 2014, 19 percent of sales were short sales or foreclosure sales. This was up somewhat from the 16.6 percent figure in April 2014, but slightly lower than May 2013, which saw 20.7 percent distressed sales.

Single family homes and condos are apparently priced right, as the median sale price figures continued to be very steady in May. The single family and condo median sale prices were both slightly higher than last year in May, and slightly lower than last month. The median sale price for single family homes was $191,500, a drop of 2.4 percent from April’s figure of $196,250, and for condos was $175,000, a drop of 4.6 percent from last month’s figure of $183,500. Median prices last May were at $189,950 for single family (virtually identical to this year) and $165,000 for condos (for a 6 percent increase this year over last).

The median sale price for the 12-month period ending in May, which moderates monthly swings, was $189,900 for single family homes, about 15 percent higher than the previous 12-month period. For condos, it was $170,000, up 8.8 percent over the previous 12-month period.

Pending sales remained strong in May 2014, hitting 1,042 after last month’s total of 1,040. This should translate to sales in June coming in near the level seen in May. Last May, pending sales were also just over 1,000.

Inventory levels dropped in May 2014 to 4,513 from April’s figure of 4,728, representing a 4.5 percent drop. Last May, inventory stood at only 3,905 homes and condos for sale in the county. The low point in the recent market was in July 2013 at 3,747, far lower than the current level.

The month’s supply of inventory stood at 5.0 for single family and 4.6 for condos. Last month, those figures were 5.3 and 4.7 respectively, and last year at this time they were 4.6 and 5.0 respectively. “We hope for continued positive numbers in the months ahead, and everything we are seeing indicates that will be the case,” said Crowley. “We haven’t experienced the type of volatility in the market that we were seeing just a few short years ago, and sometimes in real estate as in boating, a calm, steady sea isn’t so bad. We have a solid, strong market here in Sarasota.”

Source: SAR Sarasota Association of Realtors, June 23, 2014

by Helena Nordstrom – TEAM NORDSTROM, sales associate, Premier Sotheby´s International realty

Fantastiskt sjöställe i Cape Haze erbjuds till försäljning av TEAM NORDSTROM

| Till salu! TEAM NORDSTROM har det stora nöjet att erbjuda detta exklusiva objekt till försäljning.Arkitekt-ritat hus i Key West-stil, byggt 2002 och med ett fantastiskt läge direkt på Intracoastal Waterway i Cape Haze, FL, strax norr om Boca Grande, vilket räknas till ett av världens bästa områden för tarpon-fiske. Det stora huset i tre våningar med hiss om ca 650 kvm boyta erbjuder bl a 4-5 sovrum, arbetsrum, två öppna spisar och hemma-bio med bekväma fåtöljer för åtta personer. Garage för tre bilar samt goda ekonomiutrymmen inklusive stor vinkällare. Stor sjötomt om ca 2565 kvm. Den vidsträckta brygganläggningen erbjuder fyra båtplatser med segelbåtsdjup, varav två med ”boat lifts” och en med skärmtak, samt en drygt 33 meter lång kaj. Mittemot fastigheten, på andra sidan vattnet, ligger den vackra och exklusiva Don Pedro State Park Island, ett vackert naturreservat med milsvid sandstrand direkt på Mexikanska Gulfen.Pris: USD 1,895,000Kontakta oss gärna för mer information om detta eller andra objekt till salu i Tampa Bay-området. Vi assisterar gärna Dig och Dina vänner vid köp och försäljning av fastigheter i Florida! Varma & soliga hälsningar, |

Listing #:A3998151 Price: $1,750,000 Address: 80 Buccaneer Bend City: Placida State: Florida Zip: 33946 Built: 2002 Bedrooms: 4 Bathrooms: 3(1) Living area sq ft: 5,887 Total square feet: 9,448 County: Charlotte Subdivision: Cape Haze West View map of this location  |

|

|

|

“Salesmanship!”

I would like to compliment “Team Nordstrom”, Helena and Per, on the fine job and efforts they extended to me in selling my home. Not only was their work very professional, but the time extended to the sale of my home was unbelievable.

Not only did they have several Realtor showings, but spent almost each of their Sundays in my home doing “Open Houses”. The also gave me immediate “feedbacks” on each and every one of the showings.

I would recommend Helena and Per Nordstrom as prospective Realtors to anyone interested in selling their home. I would definitely use them again, if need ever be necessary.

Mary Carter – seller. May, 2014

“Congress clears bill to ease flood insurance hikes” (FAR)

On March 14, 2014 the Senate passed a flood insurance bill that will become law once President Obama signs it, which he intends to do according to his staff members. This bill will no longer require the cost of flood insurance to readjust upon the sale of a home in an area where the Federal Emergency Management Agency (FEMA) subsidizes policies. The purchaser of a home will be treated the same as the current property owner, which is great news for both buyers and sellers of waterfront properties and properties requiring flood insurance for mortgages. It will also make it possible for insurance agents to write NFIP flood insurance policies, as they did before. The new bill re-instates grandfathering, which protects old properties built to code at the time of construction from rate hikes that result from new data. The grandfathering stays with the property, not the policy and the annual FEMA rate increase is capped at 18%.

Source: Florida Association of Realtors (FAR), March 14, 2014

by Helena Nordstrom – TEAM NORDSTROM, sales associate

Premier Sotheby´s International Realty, Sarasota, FL

Florida cities tops in nation for home price increases

A report from Black Knight Financial Services (formerly Lender Processing Services) finds that December

home values in the U.S. are within 13.9 percent of the peak reached in 2006.

Black Knight’s Home Price Index (HPI) found nationally that home values rose 0.1 percent month-to-month (compared to November 2012 numbers) and 8.4 percent year-to-year. The high point for U.S. home prices was $270,000 in June 2006. In December, the HPI found a median of $232,000.

From Black Knight’s analysis, it appears most U.S. cities saw their biggest price spike last year, and their dramatic price increases have begun to slow to a more balanced level.

Florida, however, seems to buck that trend a bit, with home prices still climbing faster in comparison to other U.S. states and cities. According to Black Knight, Florida prices rose 0.6 percent month-to-month in

December, coming in second to top-ranking New York with a 0.7 percent rise. However, Florida cities logged eight of the top 10 spots for “Biggest Movers” when comparing metro areas. Only two other U.S. cities even made the list.

Biggest metro area movers month-to-month

1. Miami, FL: 1.2% month-to-month December price increase

2. Sarasota, FL: 0.9%

3. Key West, FL: 0.7%

4. Fort Walton Beach, FL: 0.6%

5. Poughkeepsie, NY: 0.6%

6. Lakeland, FL: 0.6%

7. Port St. Lucie, FL: 0.6%

8. Tulsa, OK: 0.5%

9. Naples, FL: 0.5%

10. Palm Bay, FL: 0.5%

To calculate its HPI, Black Knight says it looks at repeat sales prices and its loan-level databases. It claims the numbers take REO and short-sale price discounts into consideration.

Source: Florida Association of Realtors (FAR), February 26th, 2014

by Helena Nordstrom – TEAM NORDSTROM, sales associate

Premier Sotheby´s International Realty, Sarasota, FL

“2014 begins with Sarasota County market heating up” – SAR

New listings in Sarasota County were up substantially in January 2014, sending the total inventory to a 32-month high level, up 10.6 percent from December 2013 and yet another sign of a market in a strong recovery period.

In a recovering market, new listings and the overall inventory generally rise as sellers raise their estimation of a property’s value, but the increase normally occurs only after the market has turned up. Inventory levels are now 30 percent above the recent low in July 2013, only six months ago.

In addition, the Sarasota County market continues to witness strong price appreciation, comparing January 2014 to the previous January numbers. The median sale price for single family homes was up 21.3 percent and for condos was up 17.1 percent. While prices are markedly higher than last year at this time, prices have actually ranged in a narrow band for the last five months for condos, and for the past 11 months for single family homes. The steady nature of the median sales price is another indicator of a healthy market, without wild fluctuations or unsustainable price appreciation that was experienced in 2004-2006.

The 12-month rolling median, which moderates monthly swings, for single family homes was $187,000 in January 2014, up about 20 percent from last year at this time. For condos the rolling median was $165,000, up 10 percent over last year’s figure at this time. Pending sales rose significantly in January from the previous several months, but were lower than last January’s figures. Because of the typical length of time it takes to bring a sale to the closing table, economists consider pending sales to be a good indicator of potential future closed sales.

January 2014 closed sales were up 10 percent over last January, but down from December, a typical trend historically. During the past few years, closed sales have increased significantly in February through June. Local Realtors® are hoping that trend continues and are gearing up for a robust spring buying season. For the full year 2013, Sarasota County had the second highest number of sales ever tracked in the MLS system at 11,184, so the good start in 2014 may be a harbinger for yet another strong year.

“The Sarasota County real estate market saw near record sales last spring, so anything approaching that level would be welcome news,” said Sarasota Association of Realtors® President Peter Crowley. “The fundamentals of the market would certainly indicate a solid spring ahead. The state tourism level just hit a record high. We have had a mild winter while the northern states have experienced heavy snowstorms, and that tends to drive the level of visitors up. Once people see what Sarasota has to offer, many tend to want to relocate. And that’s where our members can certainly help.”

Sales of distressed properties represented 24.9 percent of overall sales in January 2014, up slightly from December 2013, but much lower than the 50 percent level experienced in 2011. The current inventory includes about 12.1 percent distressed properties, down from the 12.5 percent in December. A healthy real estate market is important to not only Realtors®, but to the local economy in general, with many adjunct businesses relying on home sales to spur profits.

“Our real estate market is a bright spot in an economy that has turned the corner,” Crowley noted. “The strength of the market helps produce many jobs, in the real estate field and also in many other businesses that supply goods and services to the home industry. It’s really great news for everyone when home sales are up. The unemployment rate drops, salaries tend to rise, and families prosper.”

Source: SAR – Sarasota Association of Realtors, February 20, 2014

by Helena Nordstrom – TEAM NORDSTROM, sales associate

Premier Sotheby´s International Realty, Sarasota, FL

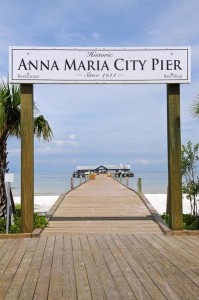

“Anna Maria Island, FL – one of the prettiest towns in America!”

Just south of Tampa, Anna Maria is a Gulf Coast beach town that has managed to avoid the sort of overdevelopment that plagues similar areas nearby – so it retains a certain small-town coastal Florida charm. With a high proportion of residences being second homes or vacation homes, Anna Maria tends to be much quieter as well. The entire city is a protected bird sanctuary, and don’t be surprised if you happen to meet a manatee during your morning swim. “It’s an important sea turtle hatching ground, and for much of the year, there just aren’t that many people on it,” says Jason Cochran, editor in chief of Frommer’s.com. “What’s funny is that even though it’s at the bottom lip of Tampa Bay, nine people out of ten in Florida don’t even know where it is. European tourists have discovered it, but it seems like Floridians have been the last to find out.”

Read the full article by clicking on the link below:

http://www.forbes.com/pictures/efel45fhdf/anna-maria-florida/

Source: Forbes.com, January 22, 2014

“Represented us as buyers in the best possible way!”

We just thought to let you know, how pleased we are with our Realtors Per and Helena Nordstrom. They have been very honest and reliable when it came to purchase our home in Nokomis. They have represented us as buyers in the best possible way. They have served us above what we had expected, and for sure “walked an extra mile” for us. We will recommend them to our European friends, and when it comes to buy or sell a home in the future, we for sure want them as our realtor. – January 2014, Lars Wangmo, M.D.

Happy New Year 2014!

We would like to thank all our friends, new and old clients for a terrific year 2013 and wishing you all health, peace and a prosperous 2014!

Let us assist you and your friends when buying or selling a home in the Sarasota area!

Sincerely,

Per & Helena

Single Family Home Median Prices in Sarasota Up 20.6 Percent

Median sale prices for single family homes sold in Sarasota County in November 2013 were up 20.6 percent over last November, according to the latest statistics from SAR (Sarasota Association of Realtors) that was published today. This is a clear sign that recent price appreciation in the single family home market is continuing. Single family home prices were at $187,000 this November compared to only $155,000 last November. For condos the rolling median prices rose with 10.1 percent over last year at this time.

With continuous high number of sales, 760 property sales (531 single family homes and 229 condos) the current inventory of properties for sale is 4,288. This translates into an inventory in Sarasota County of 5.4 months for single family and 6.1 months for condos; the number of months of inventory it would take to deplete the current inventory at the current sales rate. A 6 months inventory is considered a balanced market between buyers and sellers.

Sarasota currently seems to be experiencing the traditional increase in seasonal residents and visitors. Based on trends from previous years, we should anticipate a busy market in the mid-winter and early spring months.

by Helena Nordstrom, Sales Associate, Premier Sotheby´s International Realty, Sarasota, FL

Source: SAR (Sarasota Association of Realtors)

“Dedication beyond the normal”

Here’s hoping you and your family have a very happy Christmas and New year. It’s been over a year since my apartment sold and I wanted to thank you again for the wonderful job the both of you did. Your dedication and thoughtfulness went way beyond the normal. I have worked with 5 real estate brokers over the years but your team is far and away the best. Thanks again. All the best. Jack Piccolo, December 2013

1124 Beachcomber Ct unit 6 – Previous listing

| Designed for entertaining and resort style living, this luxury town home offers an opportunity to experience the Florida life style at its best! It´s ideally located in a gated maintenance free community of only 19 homes, a few steps away from the Intra Costal Waterway and the old swing bridge to Casey Key, marina and local restaurants. Casey Key´s beautiful beaches are only minutes away. Enter into this inviting and beautiful 2 story home with large master suite downstairs and you will be embraced by warmth and colors. The home is sold completely turnkey furnished and boasts in high quality furniture, accessories and art work. The sensational chef´s kitchen offers cherry colored wood cabinets, stainless steel appliances, large kitchen island, breakfast bar and wine cooler. Inside the cabinets you will find complete set of dining wares from Villeroy & Boch. The spacious dining area offers comfortable seating for large gatherings. The wooden stairway leads up to two guest rooms, bathroom and a balcony overlooking the heated community pool with cabana and barbeque. Plantation shutters all throughout the house and all closet interiors designed by California Closets. Built in alarm system and pre wired for surround sound system. As an extension of the indoors the outdoor screened lanai offers tiled floors, relaxed seating, outdoor kitchen with natural gas for barbeque and fridge for beverages. Outside of the lanai there is a tiled seating area to soak up the sun. Virtual tour – 1124 Beachcomber Ct #6 |

Listing #: A3988773 Price: $419,000 Address: 1124 Beachcomber Ct #6 City: Osprey State: Florida Zip: 34229 Bedrooms: 3 Bathrooms: 2/1 Living area sq ft: 2,040 Total square feet: 2,718 County: Sarasota Subdivision: Blackburn Point Marina Village View map of this location  |

|

|

|

Sarasota – The Cultural Center of South West Florida